Study: 95% of Spam Transactions Processed by Just Three Banks

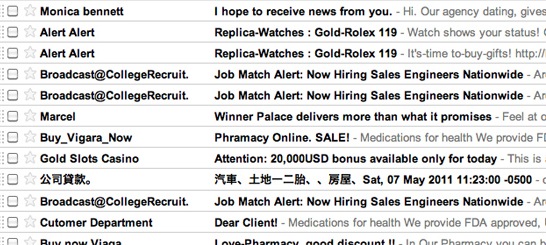

The term “spamalytics” is probably an unfamiliar one, but with spam accounting for 90% of all email traffic, it’s likely to be one of the most important fields in computer security. And a group of what one can assume are “spamalysists” have issued a report which found that 95% of all spam transactions goes through one of three banks.

The researchers at the University of California were able to uncover the banking habits of spammers by doing what most of us avoid: Inviting and responding to as many spam emails as possible for three months. In the end, their research spanned billions of messages, and 120 purchases. The fruits of their labor was the discovery that the banking and credit card processing services for spam transactions are a choke point, and possible achilles heel for spammers.

Though they are few in number, the spammers’ banks of choice are spread throughout the world: One on the West Indian island of Nevis, another based in Azerbaijan, and a Dutch bank. With the identity of the spam banks now known, the researchers hope that credit card companies will refuse to process internet transactions with these institutions, thus cutting off spammers from a quick and easy flow of cash.

With such a block in place, it could dramatically raise the cost of spam operations, forcing them out of business. Spam is, after all, scattershot by nature. The same study that revealed the spammer’s banks also determined that it takes 12.5 million spam emails to sell just $100 worth of Viagra. If the cost of that single sale was raised, it could destroy spamming as a viable strategy.

Of course, now that the research is done, the difficulty will be acting on it. It will be up to law enforcement agencies and private companies like Visa, whose services are often used in spam transactions, to act decisively and end the scourge of the 21st century.

Have a tip we should know? tips@themarysue.com