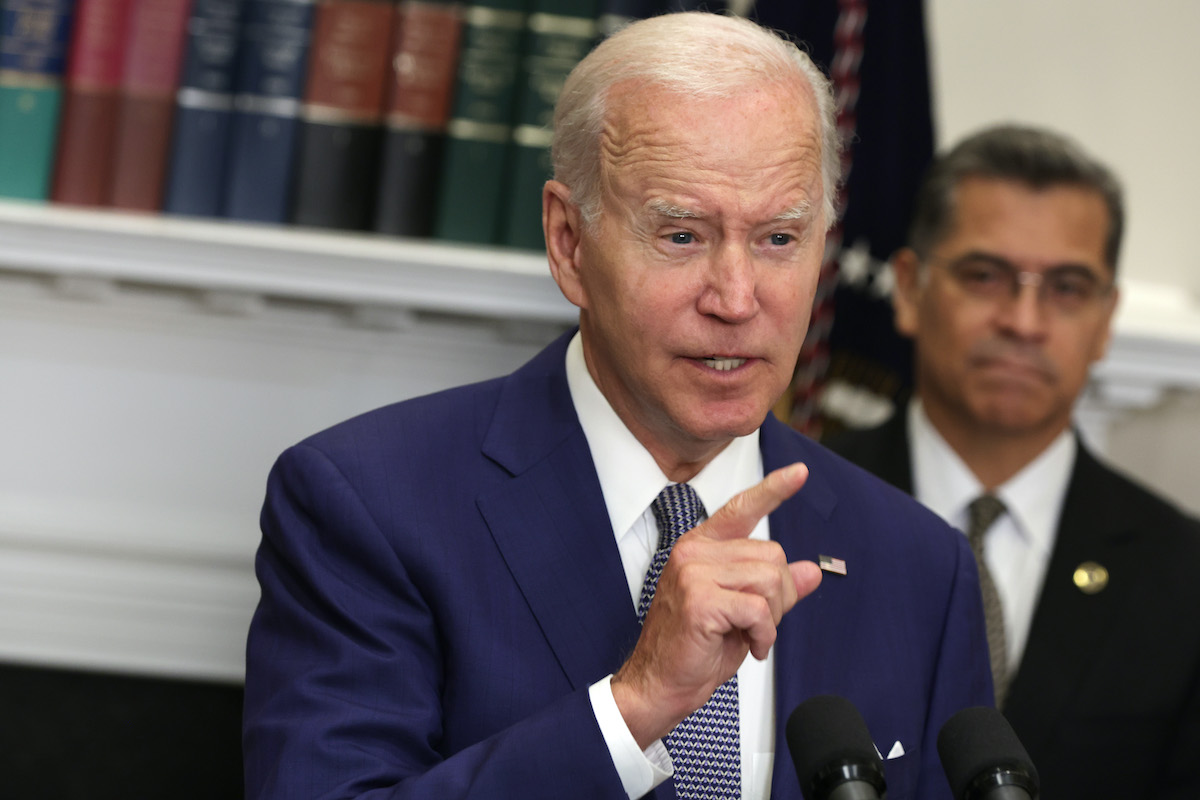

Soaring medical costs have made unpaid medical bills the most common form of debt in America, dragging down the credit scores of one in five Americans. And as we all know, low credit scores negatively impact Americans’ ability to do anything, from starting a business to even renting an apartment. Vice President Kamala Harris and the Biden administration are now seeking to change that, and while completely overhauling the insurance industry and medical-industrial complex would be a more complete solution, the proposed legislation to keep medical debt from affecting people’s credit scores is at least a place to start.

The situation with medical debt is dire. It’s not just that medical care, even with insurance, is often prohibitively expensive, with deductibles, co-pays, and coverage denial for necessary procedures. Up to 80% of ALL medical bills are calculated incorrectly! But they’re still counted against the patient’s credit score until they’re either paid or resolved in dispute, causing significant harm to seriously ill patients and their families whose resources are already stretched to the breaking point by their illness.

“We know credit scores determine whether a person can have economic health and wealth. Credit scores determine whether a person can buy a home, whether they can buy a car, rent an apartment, or own a small business.”

Kamala Harris

Though the major credit bureaus—Equifax, TransUnion, and Experian—began voluntarily omitting medical debt under the sum of $500 from people’s credit scores in July 2022, those stuck with a bill larger than that were still left in a precarious position, whether they actually owed the money or not. The proposed legislation from the Consumer Financial Protection Bureau would extend that protection to all medical debt, regardless of the amount, and encompass all credit bureaus (not just those who have been voluntarily participating so far). Though existing medical debt will still be considered during applications for medical loans, these changes should make a significant difference to the 20% of the population currently hampered by the effects of medical debt on their credit scores.

Of course, it’s not just altruism motivating this change. The major reason those credit bureaus decided to voluntarily exclude some medical debt is the unexpected and unpredictable nature of medical debt in America. Medical debt is actually a poor predictor of risk when deciding whether or not to extend credit to an individual. Moreover, the impact of medical debt on people’s credit scores has enabled illegal and predatory debt collection practices, resulting in people paying off what the CFPB refers to as “questionable debts” to alleviate the material harm caused by the impact on their credit scores. As CFPB director Rohit Chopra says,

“And if creditors don’t need to see your medical-billing history, why are we continuing to allow debt collectors to use credit reports to pressure people into paying questionable bills at all?”

Rohit Chopra

Obviously, the debt collection industry isn’t happy about this. Scott Purcell, CEO of debt collection company ACA International, warned of a “host of consequences”, as yet unspecified, if this legislation moved forward. However, according to experts in finance and economics, it seems like the negative consequences will only apply to predatory debt collection agencies that ransom people’s credit scores to coerce them into paying bills that may not even be calculated correctly.

The proposed changes are likely to take some time to get written into law, with the CFPB planning to make a formal ruling next year. However, with the backing of Harris, prominent democrats, and the rest of the Biden administration, things are looking good.

(via CNBC, featured image: Alex Wong/Getty Images)

Published: Sep 23, 2023 06:46 pm