The Senate Banking Committee held a hearing Wednesday to explore how Wall Street’s biggest banks have impacted the lives of regular Americans. And surprise, it hasn’t been great!

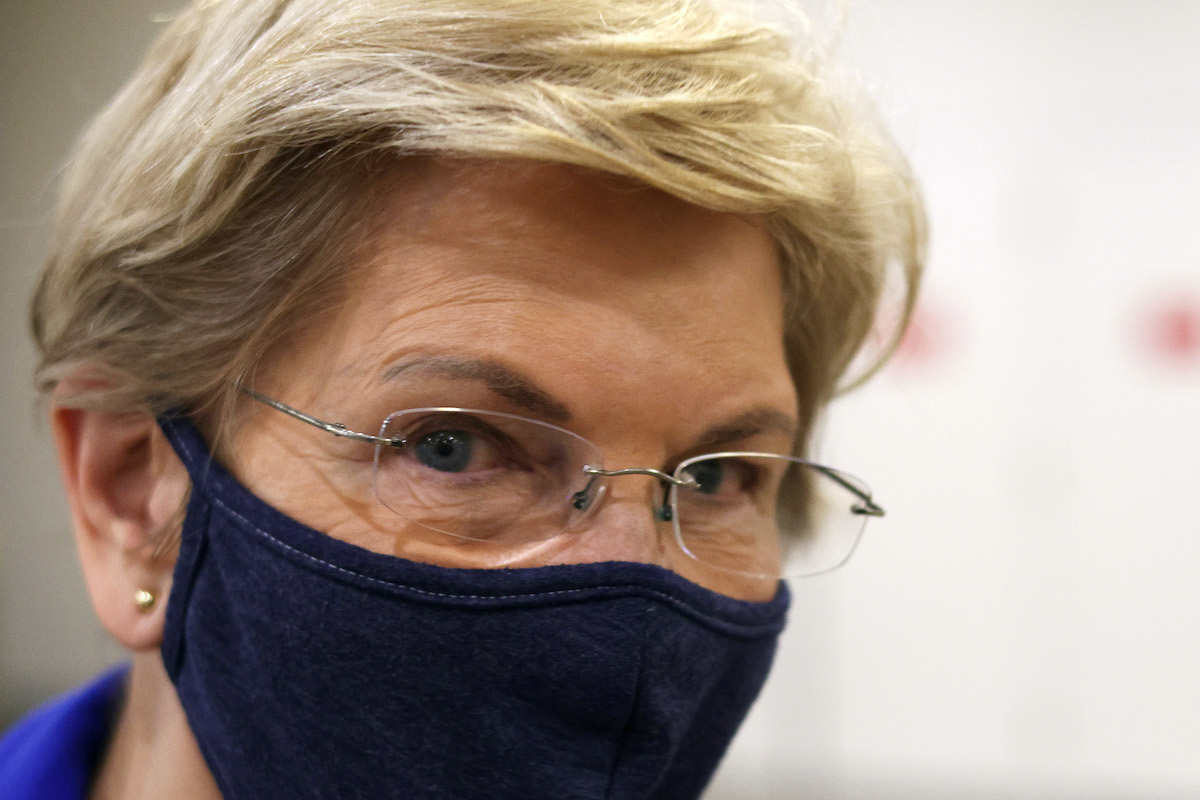

By far, the highlight of the hearing was Senator Elizabeth Warren’s questioning of JP Morgan Chase CEO Jamie Dimon. The CEOs of the country’s six largest banks were all in attendance for the virtual hearing but Warren focused hard on Dimon, whom she called the “star of the overdraft show,” thanks to the fact that his bank collects “more than seven times as much money in overdraft fees per account than your competitors.”

At the start of the pandemic, bank regulators recommended that these big banks automatically waive overdraft fees for customers. When asked to raise their hands if they did implement automatic overdraft protections, no hands went up.

Collectively, these banks collected about $4 billion in overdraft fees over the last year. And as Warren notes, the people that pay those fees are primarily poor and working people making less than $50,000 per year, people of color, and people who are already struggling to get by. Of that $4 billion, Dimon’s company collected nearly $1.5 billion.

Dimon said Warren’s numbers were inaccurate but couldn’t provide alternate figures and Warren pointed out that the numbers she had were public information. In general, Dimon seemed to be seething with smug rage and it’s no surprise, seeing as he was being publicly obliterated.

The big bank CEOs came to the Senate today to talk about how they stepped up and took care of customers during the pandemic – and I told them that’s a bunch of baloney. They nickel and dimed their struggling customers with overdraft fees to line their own pockets. pic.twitter.com/yKYwScMUs9

— Elizabeth Warren (@SenWarren) May 26, 2021

Warren asked Dimon if his company “would have been in financial trouble” if they had taken the regulators’ recommendation and automatically waived the fees. Dimon repeatedly insisted that his bank waived fees upon request, which was not the question.

“I appreciate that you want to duck this question,” Warren said. “The answer is your profits would have been $27.6 billion. I did the math for you.”

“So here’s the thing, you and your colleagues come in today to talk about how you stepped up and took care of customers during the pandemic, and it’s a bunch of baloney,” she continued. “In fact, it’s about $4 billion worth of baloney.”

Warren asked Dimon if he would commit on the spot to refunding the $1.5 billion his bank took from customers in overdraft fees during the pandemic. His response, of course, was no. None of the other CEOs would make that commitment, either.

As Warren put it, “No matter how you try to spin it, this past year has shown that corporate profits are more important to your bank than offering just a little help to struggling families, even when we are in the middle of a worldwide crisis.”

As an added bonus, Warren went on CNBC following the hearing and was asked if she thought her “attack style” actually leads to meaningful change. Warren had to laugh.

“This is not about me,” she said. It’s about the very real people and the families that make up that $4 billion in overdraft fees. Asking questions about these giant corporations’ policies is not an “attack,” it’s her job.

“That’s the best I can do in five minutes,” she said, “is to get in there and with the hard numbers that are publicly reported ask these CEOs what they did.”

Kudos to @SenWarren for going on @CNBCClosingBell & explaining that asking factual questions of @jpmorgan CEO or others like @GoldmanSachs is not “attacking” them, banks or capitalism; it’s fulfilling her duty to publicly hold powerful institutions to account for their actions https://t.co/cl8X7No6qd

— Better Markets (@BetterMarkets) May 26, 2021

(via The Hill, image: Alex Wong/Getty Images)

Want more stories like this? Become a subscriber and support the site!

—The Mary Sue has a strict comment policy that forbids, but is not limited to, personal insults toward anyone, hate speech, and trolling.—

Published: May 26, 2021 05:38 pm